For Franchisees & Location Managers

Do Less Busy-Work. Watch Revenue Run Itself.

One platform for Franchisees and Location Managers to send invoices, take payments, chase late payers, and keep every tool in sync—so you can get back to running the business.

Simplify Your Day-to-Day Operations

Franchise Operators

Focus on Growth, Not Franchise Fees

Easily track sales and automate royalty payments. Access pre-approved pricing and services. Simplify compliance reporting back to HQ.

- Automated Royalty Reporting

- Integrated Payments

- Simplified Invoicing

Multi-Location Managers

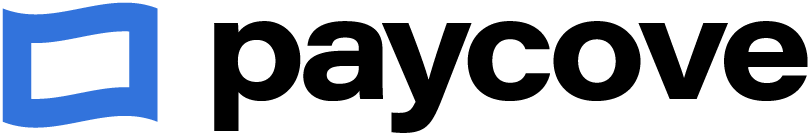

Manage Your Location Seamlessly with HubSpot, Pipedrive CRM and more

Generate invoices directly from your CRM deals. Track payments and manage collections without leaving your CRM. Sync customer information automatically.

- CRM Deal-to-Invoice

- Integrated Payment Processing

- Automated Reconciliation

Key Benefits

What you get with Paycove

Roll-up Revenue Tracking

Entity-level P&L that aggregates to brand and portfolio views

Cross-Location P&L

Real-time revenue visibility across all locations with automatic consolidation.

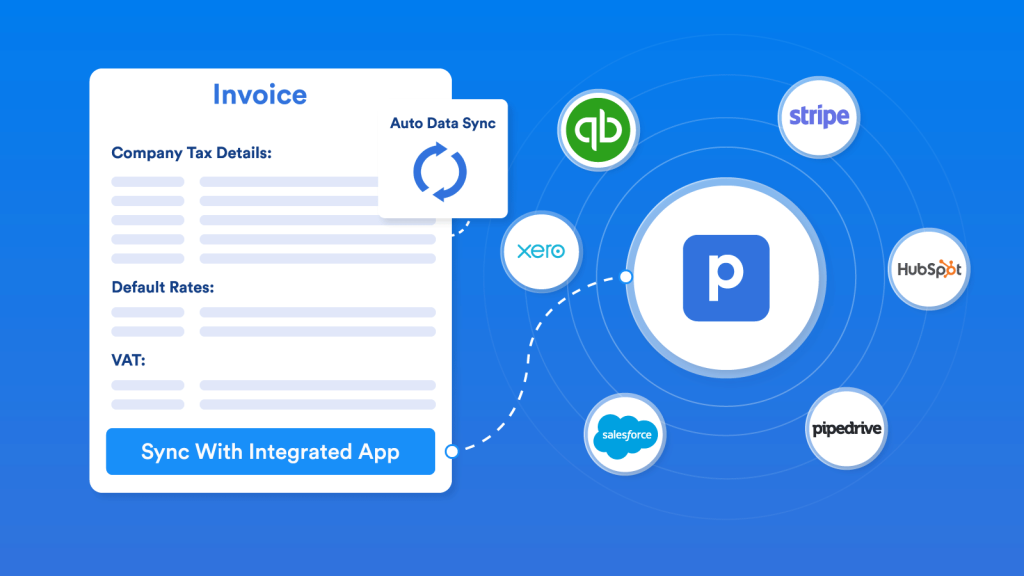

Flexible Payment Options

Accept cards, ACH, Tap-to-Pay—customers pay how they want.

Rapid Location Launch

Clone successful locations in under 30 minutes with entity templates.

Sales Team Visibility

Your sales team sees real-time revenue without asking finance.

The Problem We're Solving

Business Operations— Before & After

Tailored pain points and solutions for the operator perspective

Before Paycove

Manual invoicing takes hours

copying data between systems

Chasing late payments

manual follow-ups and tracking

Reconciling multiple systems

disconnected data sources

Unclear royalty calculations

complex spreadsheet formulas

With Paycove

1-click invoicing

automated invoice generation

Automated payment reminders

smart follow-up sequences

Synced CRM & Accounting

all systems stay connected

Transparent royalty reports

automatic calculations and tracking

Operator Success Stories

From overwhelmed to running smoothly.

Real stories from operators who transformed their daily workflows with Paycove.

Sarah M., Franchise Manager

3 quick-service restaurants

“I used to spend every morning chasing payments. Now I focus on what matters – customers and operations.”

Mike R., Operations Manager

8 fitness studio locations

“Having real-time visibility across all locations changed everything. I can spot issues before they become problems.”

Lisa K., Regional Director

12 retail franchise locations

“Franchisees love the transparency. Our relationship improved dramatically when reporting became automatic and accurate.”

Scalability

Built to grow with every location

Launch new locations in under 30 minutes—pricing rules, tax settings, and workflows copy automatically.

Real-time revenue dashboards—no manual spreadsheets.

CRM integration means your sales team sees revenue impact without calling finance.

Getting Started

How Paycove works

Start by connecting Paycove to your multi-location tech stack:

- Native CRM integrations for deal-to-cash automation

- Link your payment processor (Stripe, bank accounts)

- Connect your accounting software (QuickBooks Online / Xero)

- Set up location-specific configurations and pricing rules

Our guided setup connects your entire revenue stack in under 30 minutes.

Watch your CRM deals transform into revenue automatically:

- CRM deals automatically generate location-specific invoices

- Customers receive branded checkout links with multiple payment options

- Revenue reconciles across all locations in real-time

- Your sales team sees payment status without calling finance

Your entire deal-to-cash workflow runs on autopilot across every location.

Scale operations with confidence and visibility:

- Clone successful locations in under 30 minutes

- Real-time P&L consolidation across all locations

- Automated collections recover more cash

- Executive dashboards provide portfolio-wide visibility

New locations start generating revenue immediately with proven templates and workflows.

Ecosystem

Works with the tools you already use

Plus a clean REST API and real-time webhooks.

Questions

Frequently Asked Questions

How long does it take to set up Paycove?

Most businesses are up and running within 24 hours. Our resource guide or onboarding team (for onboarding upgrades) will guide you through the process, including connecting your existing tools and configuring your account to match your business needs.

Which payment processors do you support?

Paycove partners with Stripe to provide a modern payments collection system. We’re constantly adding new payment collection methods so you can accept money however your customers are paying.

Can I manage multiple locations or businesses?

Yes! Paycove is designed for businesses with multiple locations. You can manage each location independently while still getting rolled-up reporting and unified dashboard views.

What accounting systems do you integrate with?

We offer native integrations with QuickBooks Online and Xero. For other accounting systems, we provide CSV exports and API access.

Is there a long-term contract?

No. Paycove is available on monthly or annual plans (with a discount for annual billing). You can cancel at any time without penalty.