Are you considering managing your business finances with Bill.com but aren't entirely convinced that it is the right tool for you? Wondering whether any Bill.com alternatives would work better?

I guess it goes without saying - Everything in business revolves around financial ops. I’d dare to say that there’s no business unless you can easily create an manage invoices, process billing, manage expenses, or control budgets, etc.

But I admit, you could do it all by hand. Or use a spreadsheet or another similar solution.

But that would just take too much time, wouldn’t it? And that’s why we turn to tools like Bill.com to help streamline the process.

The thing is, not every financial ops software is the same. Each offers slightly different features, and even the things they all have in common tend to work differently across those tools.

The reason I’m saying this is because if you’re feeling a little anxious about signing up for Bill.com, you might be right. The platform might simply not be for you.

Luckily, there are plenty of alternatives to Bill.com on the market and below, we’ve listed nine amazing ones that you could try and evaluate.

Before we get to them, though, let’s take a closer look at Bill.com nonetheless.

What exactly is Bill.com?

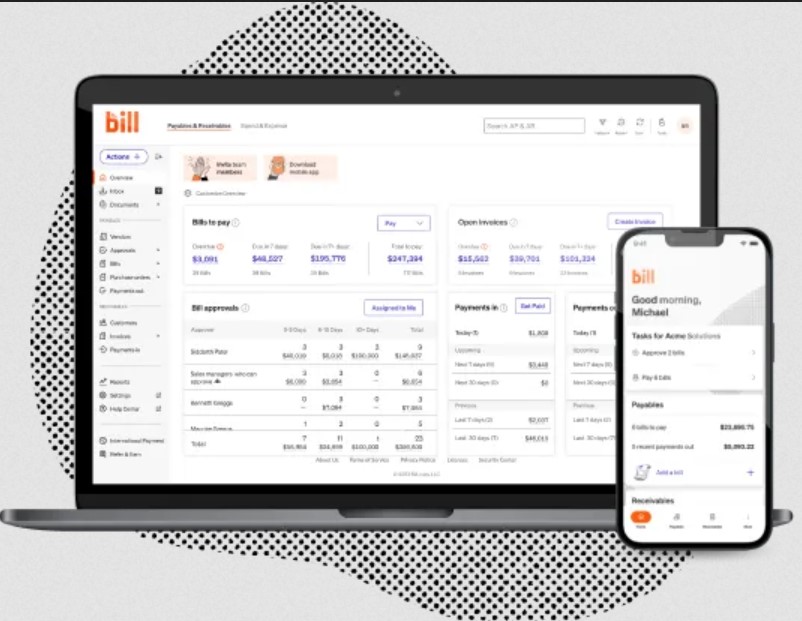

Bill.com refers to its product as a financial operations platform, and I think that’s quite an accurate label.

With Bill.com, you can create and manage invoices, bills, expenses, manage accounts receivable and payable, run various types of accounts reports, and so on.

Bill.com helps you manage your spend, too. With the platform, you can control budgets, forecast your finances, manage business credit, and pretty much do everything else to keep your company’s finances in check.

Each of these capabilities includes robust features to help manage every aspect of your financial ops with ease.

(Bill.com interface and the mobile app.)

Given such a comprehensive feature set, where does Bill.com fall short?

Well, I think it’s best if we let Bill.com’s customers answer that question.

#1. Small business focus

Don’t get me wrong, this is not a problem with Bill.com. However, I noticed that some Bill.com’s users mention how the platform focuses mainly on the needs of smaller businesses. As a result, many of its features aren’t optimized for what a larger, or growing, enterprise would need.

Needless to say, this can become a problem for you when your company grows. You could find yourself facing a move to another financial operations platform, and that’s rarely a simple thing to do.

#2. Delayed payments to contractors

I’ve also found comments regarding the usual timeline that Bill.com uses to process payments. Here’s one such comment from a review on GetApp:

“I contract with a company that uses bill.com to pay bi-monthly. The company I work for promptly processes payroll and gets it to bill.com. However, bill.com sits on your money for several days before processing it. Some of the claims are that it can't process anything on a weekend, because "banks are closed", which is a ridiculous claim to make because they pay electronically for the most part, at least in my case, and those kind of payments can be processed at any time.”

#3. Slow and often unresponsive customer support

Users across various platforms have mentioned issues with getting help and support from Bill.com.

Here’s one such story I found on Reddit.

Here’s another similar comment from GetApp:

But please do not get me wrong. Every company and team may have a bad day. Every platform you use will have its flaws, and that goes for all Bill.com alternatives you’re going to see shortly. And all of those platforms have gotten at least some bad reviews, too.

So, my point for listing those isn’t to convince you that Bill.com is a bad tool. It isn’t.

But it’s also not for everyone, and that’s why you’re absolutely right in considering an alternative solution.

So, with that in mind, let’s check out what other products you could use instead of Bill.com.

9 Absolutely Amazing Bill.com Alternatives for Your Business

#1. Paycove

Paycove (disclaimer - this is my tool,) is a dedicated invoicing CRM designed specifically to streamline quoting, invoicing, and billing processes.

But Paycove is far more than just a software for creating quotes and turning them into invoices. Far more.

In fact, we’ve designed Paycove to help you streamline and automate the entire accounts receivable process.

Here are just some of the features that make Paycove one of the top Bill.com alternatives:

- Detailed estimates: With Paycove, your sales teams can quickly generate even the most complex quotes and estimates with dynamic pricing options, automated calculations, e-signatures, and more.

- E-signatures: Easy sign off capabilities mean that customers can accept and sign your proposal quickly.

- Invoice automation: Paycove can quickly turn these estimates into invoices. You can also create invoices manually with a powerful but easy to use invoice builder.

- Flexible payment options: With our tool, you can also manage flexible payment plans, offer deposits, customizable payment schedulers, and more.

- Online payments through a deep Stripe integration.

- A wide range of billing options: Scheduled payments, subscription and recurring billing, one-time payments, progress billing, flexible billing, and more.

- Detailed reporting and analytics: Centralized A/R dashboards with real-time data updates, automated aging reports, custom dashboards to monitor the KPIs that matter to you, trend analysis, and more provide you with a single source of truth about the state of your business, help you uncover powerful insights, and drive revenue growth.

Why you should consider Paycove rather than Bill.com:

Streamline billing and payments processes: Paycove offers advanced quoting, invoicing, and payment capabilities that can help businesses automate and simplify their billing and payment process, which can [save them time and money].

Flexible payment options: With Paycove's Payment Planner feature, businesses can offer customized payment plans to their customers, which can help [boost sales and reduce delinquencies].

Greater customer engagement: Paycove's real-time tracking and reporting capabilities can help businesses keep an eye on their billing and payment process at all times, which can [help to improve customer engagement and ensure that they are providing the best service possible].

Fewer manual tasks: Paycove's 1-1 sync with Hubspot, Quickbooks, and Stripe can eliminate manual tasks, which can [help businesses focus on more important tasks].

Enhanced business growth: By streamlining their billing and payments process, businesses can use Paycove to improve their customer engagement, which can [help to boost sales and drive growth].

Next steps

If Paycove sounds like the right solution for your business, book a discovery call and let us show you how Paycove can help your business.

#2. Stampli

Stampli is an accounts payable automation platform that can help you streamline AP workflows. It’s solution is ideal for companies of all sizes that want to speed up their produce-to-pay processes.

What makes Stampli different from other tools is that it uses AI and machine learning to help you automate various aspects of accounts payable processes: approval workflow, invoice verification, and more.

Key features:

- Integrated AP-related communications

- Accounts payable automation

- AI-powered workflows

- ERP integrations.

In other words, with Stampli, you can capture invoices much quicker, speed up data entry, and streamline invoice processing.

You can also collect payments with Stampli, manage vendors, and create dashboards to monitor key data and KPIs.

#3. Invoiced

Invoiced’s name might suggest that the platform is just an invoicing software but that hardly the case. In fact, there is much more to Invoiced than this.

Invoiced helps companies streamline two specific aspects of their financial operations - accounts receivable and accounts payable.

Naturally, its feature set includes invoicing, but also billing, collections, payments, reporting, and more.

Key features:

- Automated invoicing and collections

- Online payments

- Custom dashboards and performance data

- Powerful integrations with accounting systems

- Vendor management

- Automated approval workflows, and more.

#4. Quickbooks Online

By far and away, Quickbooks is a staple of online accounting software. It’s the most recognized brand on the market, after all. Naturally, it doesn’t mean that everyone’s using it. But certainly practically every business has heard of Quicklbooks.

And certainly, it is also one of the most robust solutions on the market. Quickbooks offers an incredibly comprehensive feature set that spans anything from accounts payable to inventory management, virtual bookkeeping, payroll, and more.

This is also what makes Quickbooks such a valuable alternative to Bill.com. It’s a platform that basically does it all whereas Bill.com is more focused on accounts payable and receivable. So, if you’re looking for an all-in-one accounting solution, Quickbooks Online might be a good option for you.

Key capabilities:

- Accounting

- Virtual bookkeeping

- Payroll

- Contractor and vendor management

- Online payments

- Inventory management

- Time tracking, and a whole lot more.

#5. Spendesk

If you‘re considering using Bill.com to manage your spend, then Spendesk might be a much better alternative.

That’s because Spendesk is dedicated to help you (or your finance teams, of course) streamline the spend management process.

In fact, it’s an invaluable tool for finance teams that often find themselves buried under paperwork, waste time chasing receipts from employees, or face the constant back and forth when managing spend requests.

Key features:

- Clear visibility into payments to prepare or suppliers to pay

- Automatic receipt collection

- Detailed reporting

- Spend request management

- Expense claims management, and more.

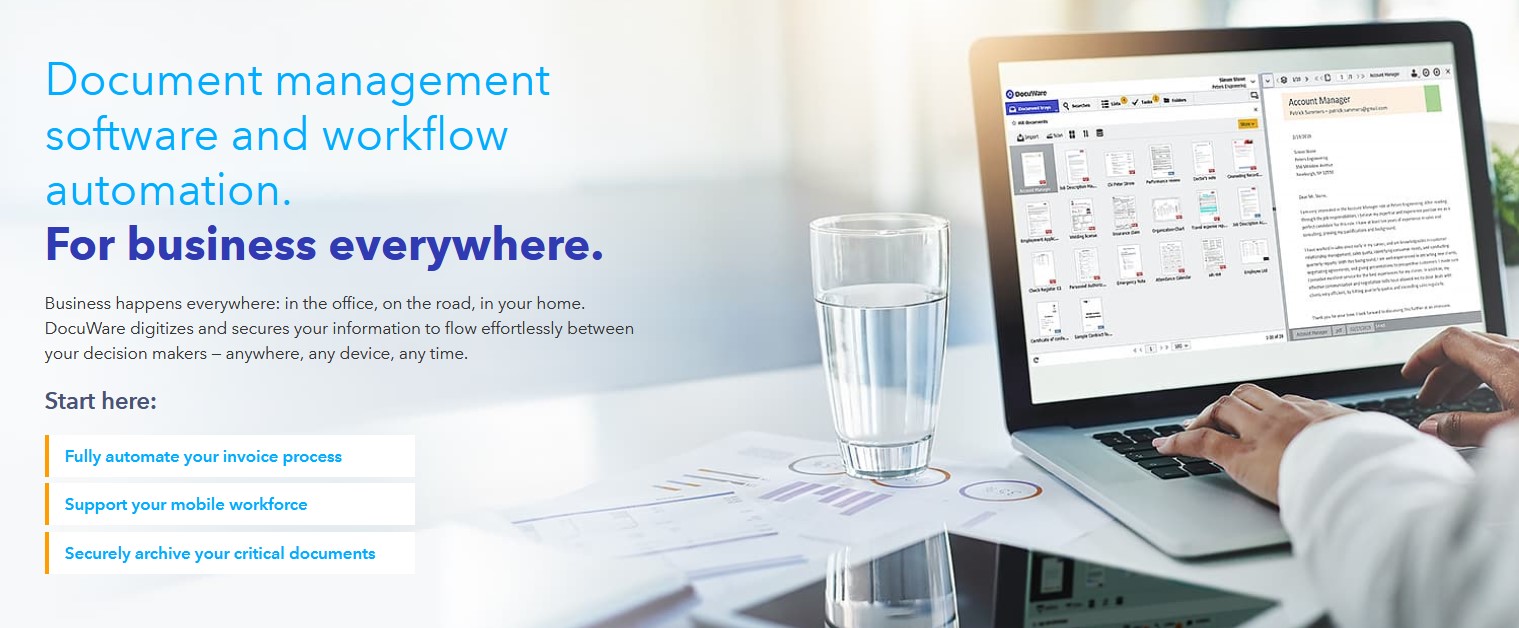

#6. Docuware

Docuware is a similar solution to Spendesk, and each tool can provide a solid alternative to Bill.com when it comes to invoice processing.

With Docuware, you can bring in all invoices in a single location, automatically extract their data, process and approve them, and more.

Key features:

- Automatic invoice processing

- Automated invoice capture

- Automated invoice data validation

- Invoice matching to other documents

- Invoice tracking, and more.

#7. Freshbooks

Freshbooks is probably the second most known accounting platform after Quickbooks. Thousands of companies around the world uses it to manage almost all aspects of their accounts payable and receivable.

They send invoices and collect payments with Freshbooks, manage accounting, taxes, vendors, expenses, even track time if billing per hour.

But it’s worth to note that Freshbooks is a software primarily targeting small businesses. It provides a robust feature set but it is all optimized to deliver on the needs of smaller companies.

Nonetheless, if you need a software to run almost all your financial ops and aren’t convinced about Bill.com, Freshbooks might be a good option to consider.

Key features:

- Invoicing and quoting

- Expense tracking

- Payment collection

- Accounting reports

- Bookkeeping, and more.

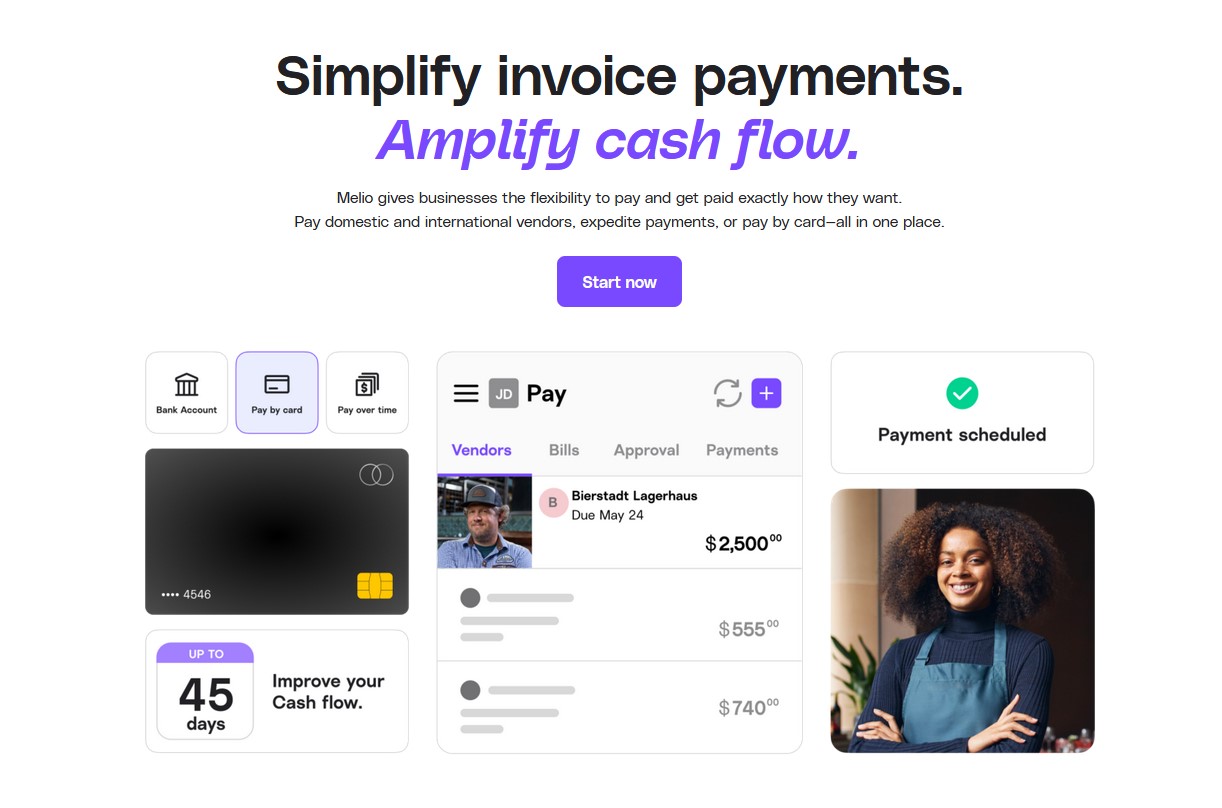

#8. Mello

Melio is another accounts receivable and payable software that could easily replace Bill.com in your business.

With Melio, you can easily send invoices and collect payments, process vendor invoices and pay any business bill, run various types of reports, and more.

What’s more, Melio offers a mobile app that allows you to manage your business’ accounts payable and receivable on the go.

But just like Bill.com and many other tools on this list, Melio focuses on small businesses primarily. Even though it offers a robust feature set, its capabilities would, most likely, be insufficient for a larger or growth organization.

Key features:

- Vendor management

- Bill management

- Payment collection

- Send and track invoices,

- Accounting reports, and more.

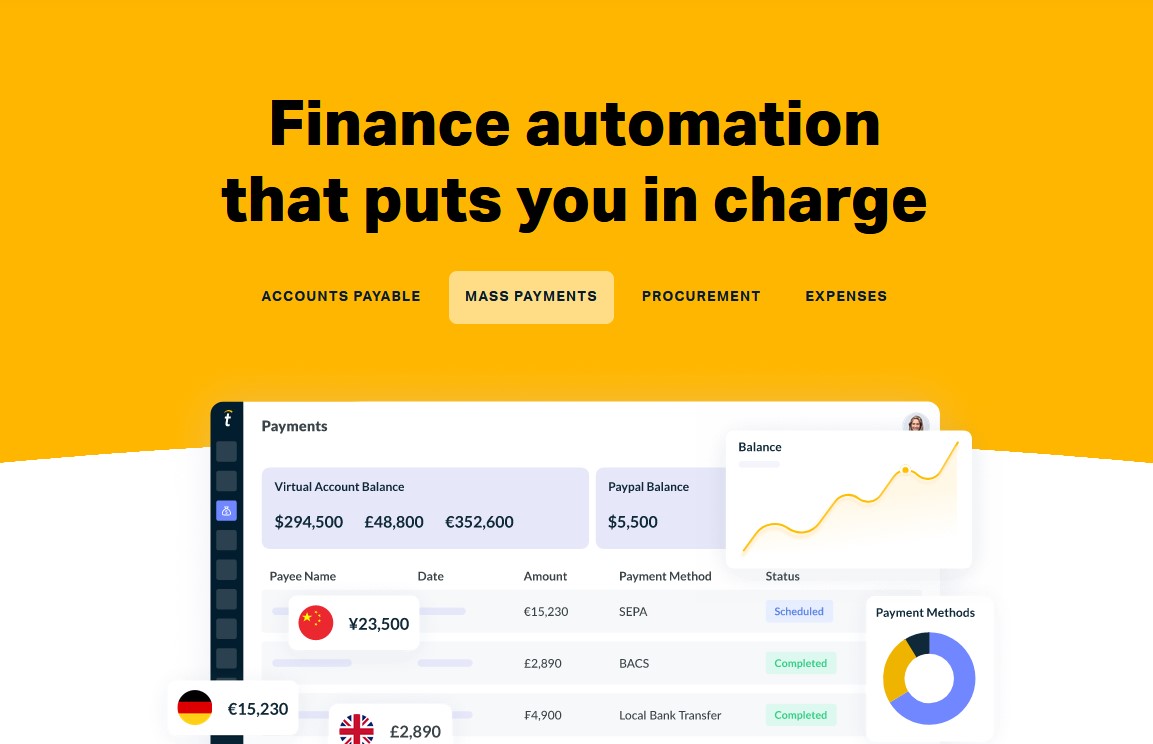

#9. Tipalti

Tipalti is an accounts payable platform focusing on helping organizations reduce the paperwork and automate routine AP tasks.

And it offers quite an incredible feature set, including machine-learning powered ability to scan and extract data from invoices, automated workflow, and more. Plus, Tipalti strongly focuses on helping global businesses. With the platform, business can pay vendors in 200 countries and 120 currencies.

So, if you’re looking for a Bill.com alternative to manage payments to vendors, contractors, affiliates, and so on, Tipalti might be the option to consider.

Key features:

- Automated invoice processing

- Machine learning powered data extraction

- Supplier management

- Tax compliance

- Automated 2- & 3-way PO matching

- Global payments

- Payments reconciliation, and more.

And there you have it…

Nine of the best Bill.com alternatives for managing your accounts payable and receivable.

All that’s left for you is to research and evaluate those products further, and try out the ones that match your company’s needs.

Good luck!